Volume. 7 Issue. 22 – June 14, 2023

Earlier this year, we featured 20-014453 v Co-operators, a case that we suggested you would want to understand, with respect to how the Tribunal reconciles “predominantly minor injuries” and access to an assessment within the home, otherwise precluded under the Schedule.

As anticipated, a central challenge from Co-operators was the finding that the nature of the injuries had materially changed, and that as a result, a “predominantly minor injury”, with pre-existing impactful injuries, cannot any longer be considered truly “minor” under the Schedule.

LAT Update – What Difference Did A Year Make?

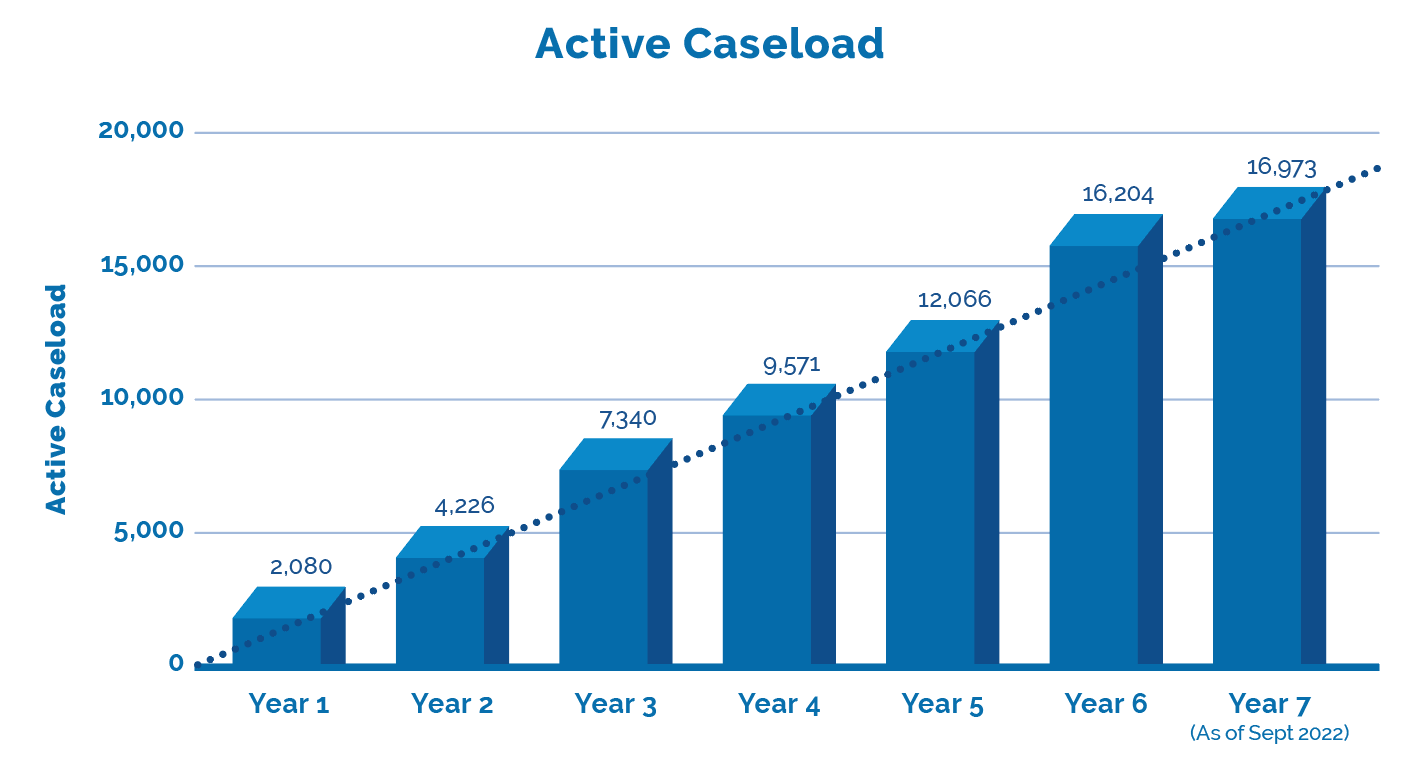

The LAT released Performance Stats up to mid-year 7 which is current through to the end of September 2022. Together with the LAT’s last update we can now provide a comparison of year over year, with projections through to the end of year 7 in this annual update. What difference did a year make?

MIG Not Separate from Minor Injury

Minor Injury and MIG Intrinsically Intertwined – The Co-operators, in 20-014453 v Co-operators, sought reconsideration of the original decision, taking issue with the suggestion that “On a plain reading of s. 14(2), an impairment that is a minor injury, must be categorized as such. Once notice is provided to an insured that they are removed from the MIG, there is no partial removal, it is a complete removal, and appropriately, the test for claims for benefits under s. 14(2) is reasonable and necessary.” In addition, Co-operators argued that the Tribunal had “conflated the defined terms “minor injury” and “Minor Injury Guideline” and read an interpretation of the Schedule that is not in accordance with the plain language of the Schedule…Co-operators further submits that “minor injury” was intended to be distinct from the MIG.

The Applicant H.B. however, argued that “Co-operators” is “creating an artificial distinction” which has the effect of creating a separate category between the MIG and “minor injury” under the Schedule.” Further, H.B. submitted that “having been removed from the MIG based on her pre-existing condition, and yet still restricted to the limits of funding and goods and services of the MIG leads to an absurd result. H.B. submits that Co-operators’ position that a pre-existing condition does not remove a claimant from the definition of a “minor injury” creates an exception to the minor injury tier of medical and rehabilitation benefits and is a flawed interpretation.”

The Tribunal agreed with H.B., “that the removal from the MIG, as a result of having a pre-existing condition (or meeting any other exception that warrants removal from the MIG), is a “removal of all constraints found within the MIG, including limits as well as goods and services.” I further agree that the MIG’s purpose would be rendered meaningless if the MIG was interpreted to mean that one can be removed from the MIG, but still be determined to suffer minor injuries, and therefore be subject to the MIG’s limit on funding and goods and services”.

The Tribunal disagreed with Co-operators “that removal from the MIG must only mean removal from the limits of that particular pre-approved treatment plan. While it makes a unique argument in interpreting “minor injury” and the MIG, I find that they are not separate, and that its interpretation is flawed.” The Tribunal found that there was “no provision under the Schedule that separates a “minor injury” from the MIG. While appreciating Co-operators’ argument that these are separately defined terms, the practical reality is that they are intertwined. Therefore, when an insurer provides notice that its insured is no longer under the confines of the MIG, this also confirms that the insurer is no longer considering that its insured’s injuries are minor.”

Further, the implication of Co-operators’ argument “is that H.B. would get $65,000 worth of funding but the goods and services are limited to those described in the MIG is contradicted by the MIG. That would essentially leave H.B. in limbo about the types of goods or services available to her and subjects her to the whims of the insurer when the accident benefits claim is not bound by the MIG (because H.B. satisfies s. 18(2) of the Schedule and section 4 of the MIG) yet the goods and services available to H.B. are constrained to the MIG. That cannot be a proper interpretation of consumer protection legislation.”

With respect to the awarding of the attendant care assessment, the Tribunal noted that “medical, rehabilitation and attendant care benefits include all fees and expenses for conducting assessments and examinations and preparing reports in connection with any benefit or payment to or for an insured person under the Schedule.’ The Tribunal noted that “H.B. submits that there is no exception for in-home assessments, and that the broad wording of “preparing reports in connection with any benefit” is consistent with the findings in my decision.” To that end, the Tribunal saw “no error of law in my interpretation of the MIG and “minor injury” or finding that H.B. was entitled to the attendant care assessment, having found that she was removed from the MIG, and therefore entitled to the next tier of benefits in accordance with s. 18(5) of the Schedule.”

Not to be deterred however, counsel for Co-operators has confirmed that they are proceeding with a Judicial Appeal to the Divisional Court.

Access inHEALTH’s research resources through Live Chat and receive your OAR. Get It now!