Volume. 3 Issue. 6 – March 13, 2019

A Harsh Reality

“To accept the respondent’s submissions that the treatment and assessment plan should be denied as being unreasonable because the hourly rate was not listed would be a harsh result…”

In 18-00838 v Aviva, the Tribunal held, “The Schedule does not state that an hourly amount must be included for the purposes of section 25 in determining if the fee is reasonable…To accept the respondent’s submissions that the treatment and assessment plan should be denied as being unreasonable because the hourly rate was not listed would be a harsh result especially considering it is within the monetary limits of section 25(5)(a). Considering the purpose of the Schedule is consumer protection and remedial in nature and as a result of the above, I do not agree with the respondent’s position that the fee is unreasonable simply because it did not state the number of hours the assessment would take.”

In addition, citing an earlier decision, 16-004375 v State Farm, the Tribunal agreed that “in determining whether an assessment is reasonable and necessary, it is relevant whether the respondent has chosen to arrange for their own assessment after being presented with the applicant’s assessment. If the respondent scheduled assessments upon receipt of the applicant’s request for their own assessment, that would appear to undermine its claim that the applicant does not require any further assessment and evaluation.”

The decision above on the costs of the assessment conflicts with earlier decisions at the Tribunal:

In 17-007475 v Aviva, the Tribunal had “not been provided with any detail in the evidence which would lead me to understand how $2,000 was arrived at for the assessment and how $200 was arrived at for the completion of the OCF form…I have no evidence of what [the assessor’s] hourly rate is, or the means of calculating her hourly rate. Without this information, I am unable to engage in the exercise of determining whether the fees charged for assessment and the form are reasonable and necessary.”

In 16-004031 v State Farm, the Tribunal found “no evidence of what [the assessor’s] hourly rate is or the means of calculating her hourly rate. This means I am unable to determine whether the treatment plan proposes an hourly rate for [the assessor] that exceeds the Professional Services Guideline hourly rate for psychologists. Accordingly, I am unable to determine whether the fees charged for the psychological assessment are reasonable.”

In 16-002947 v Wawanesa, there was no explanation by the appropriate service provider for an account of time spent in preparing for and conducting the psychological assessment. “The invoicing of professional services should be reflective of accurate timekeeping and not a default to the maximum allowed.”

In Trending… Assessments – Setting the Bar Lower

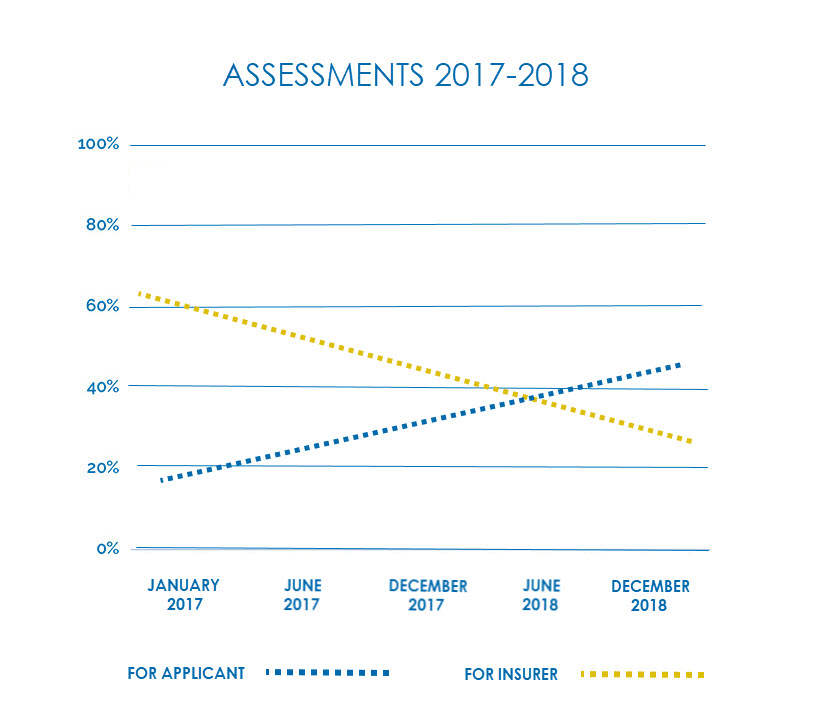

The cumulative total at year end 2018 stands at 179 decisions involving assessments as one of the benefits in dispute, with 38% of the decisions in favour of the applicant, 45% in favour of the insurer and 17% split decisions. When compared to year end 2017, the results were 33% in favour of the applicant and 55% in favour of the insurer. This reflects a 5% increase of decisions in favour of the applicant and a 10% decrease in favour of the insurer.

In 2018, a total of 93 decisions dealing with assessments were released, with results of 42% of the decisions in favour of the applicant, 35% in favour of the insurer and 23% split decisions where both parties were successful to some degree. In comparison to 2017, there is a 9% increase of decisions in favour of the applicant and a 20% decrease of decisions in favour of the insurer.

What is accounting for this convergence is the Tribunal’s consistent interpretation of what is an appropriate test when adjudicating assessments – “whether it is reasonable and necessary for the applicant to explore the reasonable possibility of impairment”. The following cases demonstrate that the Applicant’s circumstances drive what is considered reasonable and necessary.

Lowering the Bar – In 18-000655 v Echelon: the Tribunal found that the “most powerful evidence” linking post-concussion syndrome from a June 2014 accident was found in a March 2018 physiatry assessment. Despite “all of its flaws”, this report, while insufficient to prove the case on its own, was corroborated by the Applicant’s medical records.

One of the Respondent’s assessors was noted to have been looking for a “clear sign” of post-concussion syndrome. Noting that this assessor and the Applicant’s assessor found the same symptoms, the Tribunal noted, “I do not require such a high bar.” Another IE assessor found a Treatment Plan not to be a reasonable and necessary expense, given that the Applicant did not suffer from a “significant” Situational Specific Phobia. The Tribunal similarly found that “[the IE assessor] set the bar too high.”

A Most Compelling Presentation – 18-000007 v Cooperators: Awarding a psychological assessment, the Tribunal was “compelled by the psychological pre-screening note …, the section 25 reports by [the psychologist], and [the psychiatrist], and the records of [the family doctor]”. Further, “the applicant’s psychological complaints of anxiety while driving and as a passenger are consistent throughout the medical record and the service providers generally share the same diagnosis that the applicant suffers from driver and passenger phobia as well as a depressive disorder”. In addition, “[the IE assessor]’s divergent opinion that the applicant’s psychological injuries are consistent with the MIG does not outweigh [this] evidence and shared opinion…”.

Conflicted Findings – 17-008633 v Aviva: Determining that the Applicant was not entitled to a psychological assessment, the Tribunal noted that the records of the family doctor “did not provide any diagnosis of the applicant, other than stating that he still has anxiety with work and family stress”. The Applicant’s assessor noted “mild levels of emotional distress”, and “low levels of depression and anxiety”, yet he diagnosed the applicant with “Adjustment Disorder with Mixed Anxiety and Depressed Mood” based on the clinical interview which suggested a level of emotional distress “more significant” than what was represented in the test responses. Another assessor for the Applicant confirmed “inconsistent responding and a general tendency to over report somatic and cognitive symptoms and complaints”, but otherwise suggested “current symptoms of anxiety, depression, somatic preoccupation/focus, and perception of relative functional impairment”.

Given the “conflicting findings”, in conjunction with the lack of a clear diagnosis, evidence of unrelated stressors and the IE finding of “minimal levels of psycho-emotional distress”, the Applicant failed to show that the proposed psychological treatment is reasonable or necessary.

Begging the Question – In 17-008702 v Certas: The Tribunal gave “no weight to the treatment and assessment plan proposing the psychological assessment because the pre-screening makes no reference as to why the pre-screening was done in the first place”.

The Tribunal noted that “it appears that the pre-screening was conducted solely for purpose of providing evidence in support of a psychological assessment in the absence of other evidence.” Accordingly, “considering the absence of evidence in the medical record to indicate the need for further inquiry, I find the treatment and assessment plan unnecessary.”