News Update – February 19, 2025

This week’s LAT inFORMER is a Breaking News edition where the court opted to set aside a Tribunal decision regarding a supposed failure on the part of an Applicant to provide the requisite S.32 notice regarding injuries sustained. Consumer protection reigns supreme here, with the court imposing a positive obligation on insurers to specifically inquire as to the existence of injuries having been sustained.

Virtual Training – New Sessions Added!

Secure your seat for inHEALTH’s 2025 upcoming Virtual Training sessions!

- BI Fundamentals: March 31- April 4, 2025

- SABS Expedited: May 5-9, 2025

*Eligible Participants receive 9 Substantive – CPD hours upon course completion

Course details & register here +

Court Sets Aside Tribunal S.32 Notice Decision

17 Month “Delayed Notice” a Non Issue – In Hussein v Intact, Following a February 2019 MVA, the Appellant Hussein advised his insurer Intact, one day post MVA, that he had been involved in the MVA. Intact’s file reflected that Hussein’s vehicle had sustained “heavy damage.” Intact never questioned Hussein as to whether he had suffered any personal injuries and never advised him of his entitlement to statutory accident benefits. Hussein did not file his claim for accident benefits until seventeen months later, explaining that the delay was because of his only becoming aware that he was entitled to accident benefits when he spoke to a paralegal.

Injuries

Subsequent to the MVA, Hussein sought treatment for his injuries. He paid for this treatment out of pocket until December 2020, when a paralegal informed him of his entitlement to accident benefits. Initially, Intact approved Hussein’s application for benefits and he attended a few Insurer’s examinations. However, on April 12, 2022, Hussein received notice that Intact was terminating his benefits because of the delay in making his application. Since the accident, Hussein has not been able to return to work. He applied to the Ontario Disability Support Program and his application for income support benefits was approved. By December of 2023, doctors were agreeing that Hussein could have sustained a catastrophic impairment as a result of the accident. Since then, his depression has worsened to the point that on January 31, 2024, he was hospitalized after a suicide attempt.

Tribunal Decisions

Following the denial, Hussein applied to the LAT for a resolution of his dispute. The Tribunal denied his application for benefits on the basis that he failed to notify Intact of his claim within seven days and that his explanation for the 17-month delay in making his application was not credible. The Tribunal determined that Hussein “had not notified Intact of his intention to apply for accident benefits within the prescribed time period of seven days. Reporting to the Insurer that he was in an accident was not enough. He never advised the Insurer that he had suffered personal injuries and the Insurer had no obligation to inquire.” He then requested that the LAT reconsider its Decision, however that request too was denied. The Tribunal found that “First, he knew enough to claim property damage. Second, his policy set out that he was eligible for accident benefits.” The Tribunal further “found that the Insurer had no obligation to advise the Insured of the availability of accident benefits. As put by the LAT, “there is no such obligation in the Schedule.”

Hussein v Intact is an appeal from both the Decision and the Reconsideration Decision. The court herein allowed the appeal, set aside both decisions and found that Hussein’s notification to the Insurer that he had been in an accident was sufficient notice to satisfy the seven-day deadline for notice under the legislation. “Fundamental to the decision” was “the fact that the SABS is consumer protection legislation, which must be interpreted in a manner consistent with its objective – to reduce economic dislocation and hardship for victims of motor vehicle accidents.”

Tomec and Consumer Protection

The court referenced the earlier court in Tomec, that “The SABS are remedial and constitute consumer protection legislation. As such, it is to be read in its entire context and in their ordinary sense harmoniously with the scheme of the Act, the object of the Act, and the intention of the legislature. The goal of the legislation is to reduce the economic dislocation and hardship of motor vehicle accident victims and, as such, assumes an importance which is both pressing and substantial.” Tomec also confirms that “faced with a choice between an interpretation of the statute “that furthers the public policy objectives underlying the SABS and one that undermines it, the only reasonable decision is to side with the former”.

Tribunal Precedents

For his part, Hussein relied upon three precedent cases of the Tribunal. In Ilangeswaran v. Sonnet the insured “made a call to the insurer to report her accident within the seven-day period, but the call was disconnected before the insured reported any injuries. The LAT found that the insured had notified the insurer of her claim for accident benefits. If the insurer wanted to clarify with the insured as to whether she had been injured, it should have called her back.” In M.O. v. Jevco the LAT found that “when the insurer received notice of the insured’s tort claim, this was sufficient to constitute notice under the SABS of an accident benefits claim. The Tribunal found that at that point the insurer would have been alive to the potential of an accident benefits claim and should have reached out to the insured’s guardians to advise them of their rights to make a claim. The Tribunal found at para. 12 that “considering the Schedule is consumer-protection legislation, Jevco’s actions are alarming.” Finally, in K.H. v. Northbridge the Tribunal “articulates the insured’s obligation to give notice under s. 32(1) in the following manner, at para. 7: Section 32(1) of the Schedule requires an insured person to inform an insurer of an accident within seven days, at which point the insurer will provide the insured with the application forms for accident benefits. (emphasis added).

Get Your Stats Report!

inHEALTH’s Statistical Reports provide insights and analysis on the outcomes of Licence Appeal Tribunal (LAT) and court decisions.

Customize success rate reports on any variable relating to disputed AB claims captured in LAT and court decisions!

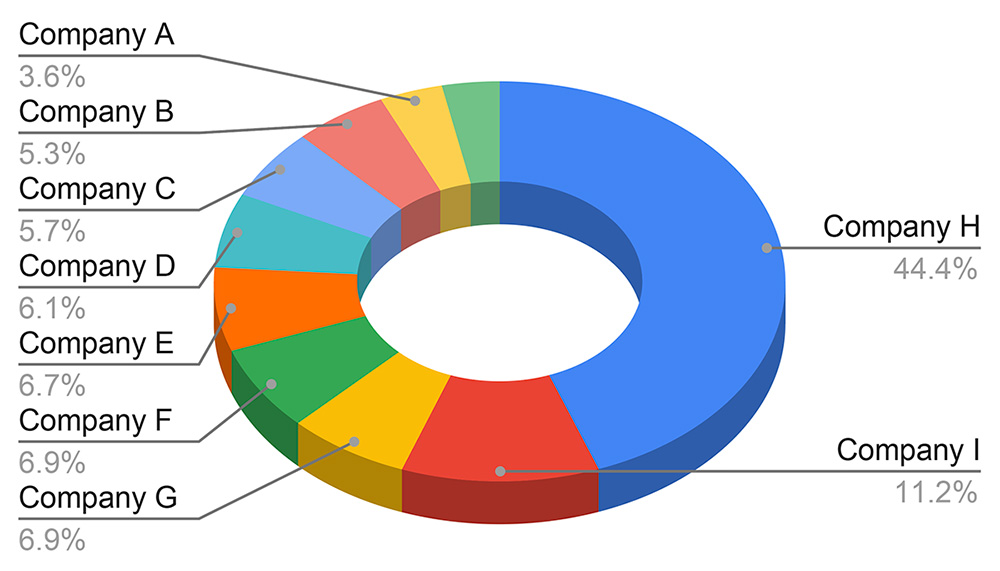

Decisions By Top 10 Insurers

*Sample Chart

Statistical Report fees are based on the complexity of your data request

Learn More & Get a Quote Here >

Insurer Has Positive Obligations to Inquire

The court found that the Tribunal in this matter, “essentially found that since the Insured in this case did not advise the Insurer that he suffered injuries in the accident, the Insurer had no obligation to make further inquiries or to advise the Insured of his right to claim accident benefits. According to the Insurer, the wording of s. 32(1) is clear – the onus is on the Insured to give notice within seven days and that notice requires the Insured to be specific about the fact that the nature of his claim is one for accident benefits. This interpretation is neither consistent with the Tribunal’s case law, nor consistent with the consumer protection purpose of the SABS. In both Ilangeswaran and M.O v. Jevco, the Tribunal found that once the insurer became aware of an accident, notice had been given of the claim for accident benefits. If the insurer wished to clarify more, it was their obligation to make inquiries.”

Further in this case, the Tribunal “found (based on the evidentiary record before it) that the Insured told the Insurer that he had been in an accident in which his vehicle has sustained “heavy damage.” The Insurer did not ask if the Insured had been injured in the accident and did not advise him that if he had, he could not only obtain coverage for the damage to his vehicle, but he could also claim accident benefits for his personal injuries. According to the Insurer and the LAT, to read s. 32(1) of the SABS in a way that requires any such action on the part of an insurer would run contrary to the wording of the SABS.”

The Court Explains Consumer Protection Mandate

It was noted that “consumers who have motor vehicle accidents are in a vulnerable position, particularly in the period immediately following an accident. Seven days is a very short notice period. Insurance contracts are complicated documents that the average consumer is unlikely to read. If they do read the document, they are unlikely to remember its contents if they have an accident, which could be many years later. The entitlement to damages for motor vehicle accidents in Ontario and the role of the SABS in that regime is not something that it is fair to assume the average consumer would be familiar with. Insurance adjusters and agents, on the other hand, can be presumed to know that if one of their insureds has an accident and is injured in that accident, they will want to make a claim for accident benefits. An interpretation of s. 32(1) that recognizes these realities is one that fosters the consumer protection purpose of the SABS. An interpretation that ignores these realities does the opposite. The interpretation of s. 32(1) in the decisions under appeal ignores these realities. As such, it undermines the consumer protection purpose of the SABS.”

Failure to Meet Obligation(s)

The court concluded that the “notice requirement was met when the Insured advised the Insurer one day after the accident that he had been in an accident. A reasonable insurer would assume that an insured who has been in an accident intends to access all the benefits available to them under their policy. If the insured has been injured in the accident, this will include accident benefits. If the Insurer in this case wished to clarify which specific benefits the Insured intended to access, the Insurer could have asked the Insured whether he sustained any injuries. As the Insurer chose not to ask any more questions, it should have acted on the assumption that the Insured would want to apply for accident benefits. At that point, the Insurer should have complied with its obligations under s. 32(2) of the SABS, which included sending out the necessary application forms and an explanation of the benefits available. This is an interpretation that fosters the consumer protection purpose of the SABS.” The court did not accept Intact’s submission that this would put an unfair financial burden on insurers and would precipitate an increase in the number of claims, many of which could be illegitimate.

Legislative Change to Facilitate Easier Denials?

Intact also suggested that the “Legislature deliberately changed the wording of s. 32(1) in 2003 to place an onus on the claimant to notify the insurer of their specific intention to bring a claim, rather than imply that they must only report that an accident occurred. I disagree. While the precise words used in s. 32(1) may have changed, the changes make no substantive difference to the meaning of the section, except to reduce the notice period from thirty days to seven days. The Insurer’s argument is, in effect, that in 2003 the Legislature changed the wording of s. 32(1) not only to facilitate an insurer’s ability to investigate and assess the circumstances of a claim expeditiously by shortening the period of notice, but also to increase the requirements for notice so that it would be harder for an insured to give proper notice. Implied in this argument is that the Legislature wanted to make it easier for insurance companies to deny claims and harder for insureds to make claims. In the absence of any evidence that this was the case or any rationale as to why this would be the case, I am not prepared to find that this was the Legislature’s intention”.

Disposition

Therefore, the appeal was allowed, the Decision and the Reconsideration Decision are set aside and the Insured’s application for accident benefits is referred back to the LAT to be disposed with the understanding that Hussein in fact did satisfy his obligation to give notice under s. 32(1) of the SABS. As agreed by the parties, Hussein was entitled to his costs of the appeal, fixed in the amount of $6,000.00.

Access inHEALTH’s research resources through Live Chat and receive your OAR. Get It now!