Volume. 9 Issue. 6 – February 12, 2025

This week the Tribunal considers a matter involving an employed individual who sought pre and post 104 IRB. In addition, the Applicant sought a CAT designation, with the Tribunal finding there to be more than one marked impairment. The Tribunal also considers somewhat involved quantum considerations, specifically related to post MVA earnings.

Virtual Training – 2nd Winter Session Added!

By popular demand a 2nd winter session has been added for BI Fundamentals virtual training! Secure your seat now!

- BI Fundamentals: March 31- April 4, 2025

*Eligible Participants receive 9 Substantive – CPD hours upon course completion

Course details & register here +

Post 104 IRB Despite Employment & No CAT As Only Two Marked Impairments

Two Marked Not CAT, IRB Despite Employment – Injured in a May 2021 MVA, the Applicant Festarini sought entitlement to a number of medical benefits, both pre and post 104 IRB, including a quantum determination, as well as a determination that he had sustained a CAT impairment. In 24-002069 v Aviva, we will examine the claims related to IRB and CAT. Ultimately, Festarini did not satisfy the Criterion 8 test, having been adjudged to suffer from only two marked impairments. However, despite ongoing employment, albeit in a limited manner, as a commercial real estate advisor he was found entitled to both pre and post 104 IRB, at the rate of $400/week, less 70% of employment income for those weeks he received same.

CAT

It was the position of Festarini that he had sustained a marked impairment in three areas of function, being Social Functioning (SF), Concentration Persistence and Pace (CPP) and Adaptation (AD). There was no suggestion of a marked impairment in the domain of Activities of daily living (ADL). Conversely, Aviva took the position that the MVA did not cause him to sustain a marked impairment in any of the four areas of function.

Social Functioning

The Tribunal found there to be several aspects of social functioning in which Festarini was significantly impeded. However there was evidence as well of useful functioning that included a developing relationship post MVA with his girlfriend and the ability to (twice) travel internationally. He was also found to have testified in an articulate manner at the hearing. His employer confirmed that he has been able to interact appropriately with others in a work setting. Both assessors (s.25 & s.44) confirmed appropriate interactions during their respective assessments. Ultimately, the Tribunal concluded that Festarini’s mental and behavioural disorder allows for some useful functioning in the area of social functioning, which corresponded with a moderate impairment. Therefore, Festarini did not attain a CAT designation given the fact that he had conceded ADL to be a non issue. However, the Tribunal addressed the other two domains for the sake of completeness.

CPP

The Tribunal found that Festarini had sustained a marked impairment in the area of CPP. His employer’s evidence was that his productivity level suggested he was doing approximately 2 hours of work per week. Festarini himself testified that he typically worked for 30 to 45 minutes at a time before needing to take a break. The Tribunal noted Festarini’s need to take frequent breaks during his testimony at the hearing. Aviva relied upon its expert Neuropsychologist, who reported that Festarini worked at an average pace and persisted on most tasks during the testing, despite their increasing difficulty levels. The assessor however also reported that Festarini took frequent 10-15 minute breaks during the testing. Aviva also relied on surveillance video showing Festarini golfing with his girlfriend as evidence of his ability to concentrate for a prolonged period of time. The Tribunal, though did not accept Aviva’s submission that a casual game of golf requires the player to sustain concentration for the duration of the game.

Adaptation

The Tribunal found that Festarini sustained a marked impairment in the area of adaptation. While noting that he repeatedly reported that he was working 20 hours per week, the evidence of his employer rather suggested that he has repeatedly over-stated his abilities in this respect. As noted above, the employer estimated that the actual productivity was more in line with approximately 2 hours of work per week. The Tribunal found that Festarini’s “continued employment is due to the employer’s acceptance of the applicant’s impairments and a decision to let the applicant “do his thing” without questioning his output or why his sales numbers are so low. We find that the applicant’s continued employment is a reflection of the employer’s decision to accommodate the applicant’s impairments and is not a reflection of the applicant’s functional ability to perform in the workplace.”.

Get Your Stats Report!

inHEALTH’s Statistical Reports provide insights and analysis on the outcomes of Licence Appeal Tribunal (LAT) and court decisions.

Customize success rate reports on any variable relating to disputed AB claims captured in LAT and court decisions!

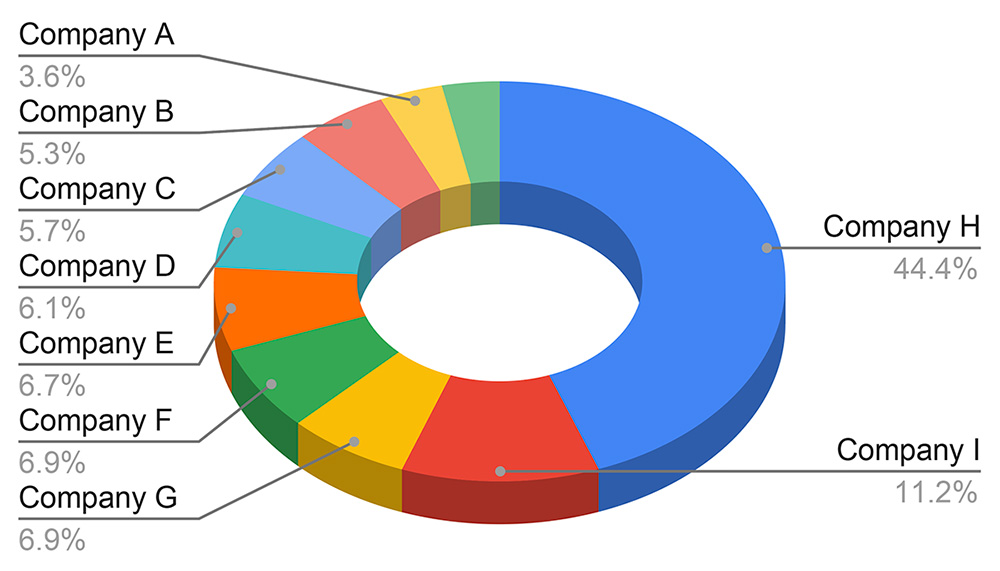

Decisions By Top 10 Insurers

*Sample Chart

Statistical Report fees are based on the complexity of your data request

Learn More & Get a Quote Here >

IRB

Pre-104 IRB

The Tribunal found that Festarini was entitled to pre104 IRBs. In the capacity of a commercial real estate advisor, the essential tasks of employment were determined to be: “making a high volume of cold calls, researching properties, driving to properties for site visits, meeting with clients, reviewing contracts, communicating with clients by telephone and email. Additionally, working long hours and working from the office were considered essential…”. Festarini testified regarding “his headaches, fatigue, irritability and other symptoms and how they prevented him from performing many of the essential tasks of his employment post-accident. For example, he testified that he was unable to make cold calls, visit properties or work from the office post-accident. In addition, the applicant testified that his impairments prevented him from performing the remaining essential tasks at anywhere near his pre-accident level.”B

Aviva’s expert Rai however, concluded that there was no cognitive or psychological basis for Festarini to be unable to perform the essential tasks of his employment. The Tribunal took issue with numerous aspects of Rai’s evidence. One example being the failure to explain some of her own objective observations. Dr. Rai “noted that the applicant was “symptom focused” and needed to take frequent 10–15-minute breaks during testing. However, she did not explain whether or how she accounted for these observations in formulating her opinion that there was no cognitive or psychological basis for the applicant to be unable to perform the essential tasks of his employment.”

Further, “Dr. Rai’s conclusions are internally inconsistent. Dr. Rai did not explain how she found that the applicant was symptom focused and self-limiting, which was likely impacting his ability to complete work duties and which should be addressed in psychotherapy, yet also opined that the applicant’s psychological symptoms were unlikely to interfere with his ability to perform his regular work duties.”

In addition, “Dr. Rai’s narrative of the applicant’s reports of his functional abilities are vague and inconsistent with the remainder of the evidence we heard. For example, Dr. Rai’s reports note that the applicant had returned to work but was “not as productive as he was prior to the accident.” Dr. Rai also noted that the applicant reported that he continues to drive, drives himself to his therapies, is able to drive safely and is able to focus well on the roads. While not inaccurate, we find that these statements are incomplete and do not paint a true picture of the applicant’s abilities. In particular, describing his return to work as being “less productive” is vague and minimizes the true extent of his inability to perform his work duties.”

Post-104 IRB

The Tribunal found as well that Festarini was entitled to post-104 IRB. The Tribunal determined that based upon his experience and education, that he would be reasonably suited for a wide range of jobs in sales, real estate or business generally, as well as potentially being reasonably suited for a job related to hockey, such as coaching. Festarini’s expert Shahmalak assessed his competitive employability, finding “that he would expect the applicant’s impairments to prevent him from completing work in a timely way and from being productive at work. He also found that from a psychiatric perspective, the applicant was unlikely to be able to attend work on a consistent and reliable basis. Dr. Shahmalak also determined that the applicant was likely to be involved in workplace conflict with co-workers or customers as a result of his severe stress intolerance.” The expert further testified that Festarini “was likely to perform worse at a new position, where one would not expect the same level of support and understanding that the applicant’s employer has extended to him since the accident.”

Aviva relied on the multi-disciplinary report dated May 6, 2022, in support of its submission that the applicant does not suffer from a complete inability to engage in any employment or self-employment for which he is reasonably suited by education, training or experience. Of note, neither of the assessors involved addressed the post-104-week test explicitly in their report, each simply opining that Festarini did not meet the pre-104 IRB test. Similar to the findings above, more weight was afforded the report of Festarini’s expert. In addition, the testimony of Festarini and his employer established that he was “unable to work from the office, is unable to work for more that 30 minutes at a time without a break, requires numerous and lengthy breaks and is unproductive during the time he is able to spend working. We find that Mr. Garrigan has been extremely supportive and accommodating of the applicant since the accident and it is unlikely that the applicant could find another work environment where the employer would be as accommodating, given his impairments.

Quantum of IRB

The Tribunal determined that Festarini’s “employment income should be attributed to him during the week it is received, rather than the week the relevant deal becomes firm. For the calculation of post-accident income, 70 per cent of the gross employment income received by the applicant in a given week should be deducted from the IRB payable in that same week. This will result in an IRB being payable for the weeks when the applicant does not receive any commission.” Aviva took the position that Festarini was entitled to $0.00 in IRBs per week due to the amount of post-accident income that he has earned.

Employment Earnings

The Tribunal noted that there were disagreements regarding whether commission income earned by Festarini should be attributed to him during the week it is received or during the week the relevant deal becomes firm, and the method of calculating post-accident income earned by Festarini. The Tribunal found that “commission income earned by the applicant should be attributed to him during the week it is received rather than during the week the relevant deal becomes firm. We find that this method, as proposed by the respondent, is more consistent with the Schedule. The parties agreed that the applicant is an employee. The language of s. 7 of the Schedule refers to income “received” by an employed person and “earned” by a self-employed person.”

Calculating Post-Accident Income

The Tribunal agreed with Festarini that the income received in a given week “should be deducted from the IRB payable that week only and that any additional income over that which is required to bring that week’s IRB to zero should not get carried forward and deducted from the IRB payable during other weeks. This method of calculation results in an IRB payable to the applicant during weeks when he does not receive any commission.” Conversely, Aviva submitted that income earned post-accident should be averaged over the course of a year and 70 per cent of that average gross employment income should be deducted from the IRB payable for that year to give an average weekly IRB. It was suggested that this method more accurately represented the weekly earnings since the accident.

The Tribunal noted that “the Schedule uses the word “received” in relation to employment income. This is in contrast to references to income “earned” by self-employed individuals. The parties agreed that the applicant is an employee and that the commissions he receives are employment income. On a plain reading of s. 7, an IRB is calculated on a weekly basis. The reference in s. 7(3) to earned income being relevant to self-employed individuals only indicates that the respondent’s method of calculation would be more appropriate for a self-employed individual. We find that in these circumstances it is more consistent with the Schedule to deduct 70 per cent of the gross employment income received by the applicant in a given week from the IRB payable in that same week.”

Therefore, IRB of $400 per week was payable for the weeks that Festarini did not receive any income, from January 11, 2022, to date and ongoing. As for the weeks that Festarini had received income, Aviva was entitled to deduct 70 per cent of the gross employment income received that week from the IRB for that week.

Access inHEALTH’s research resources through Live Chat and receive your OAR. Get It now!