Volume. 9 Issue. 3 – January 22, 2025

This week the Court of Appeal weighs in on an earlier court decision that allowed the Applicant’s appeal from a Tribunal decision. It is noteworthy that the insurer essentially changed its positioning regarding the appeal before the court during oral arguments.

Virtual Training – Fall Sessions!

Secure your seat for inHEALTH’s 2025 Winter Virtual Training session!

- SABS Expedited: February 10th – 14th, 2025

*Eligible Participants receive 9 Substantive – CPD hours upon course completion

Course details & register here +

Court of Appeal Upholds Divisional Court Decision

Background

Discoverability Rules – The Applicant Tagoe, in The Personal Insurance Company v Tagoe, was involved in an automobile accident on April 28, 2016, taking but one day off work post MVA. He submitted an Application for Accident Benefits form (OCF-1) The Personal Insurance Company (“TPIC”). In Part 8 of the application, headed “Income Replacement Determination”, Tagoe provided his employment details and checked off a box indicating that his injuries were not preventing him from working. Subsequently, an OCF-3, indicated that Tagoe was “substantially unable to perform the essential tasks of [his] employment”, however that he would be able to “return to work on modified hours and/or duties”. An explanatory note further stated that “Patient has been advised not to return to work but due to financial reasons he has returned with pain and discomfort.”

On May 20, 2016, TPIC sent Tagoe an “Explanation of Benefits” (“EOB”) form indicating that he did not qualify either for IRBs or for any other form of disability benefit. With respect to IRBs, the EOB stated “You do not qualify for an income replacement benefit because you do not suffer from a substantial inability to perform the essential tasks of your employment. With respect to NEB, the EOB “inconsistently’ stated that “You do not qualify for a non-earner benefit because you qualify for an income replacement benefit.”

Disability Commences 16 Months Post MVA

Tagoe continued to work for approximately 16 months after the accident, after which he ceased working for medical reasons. He underwent right hip arthroplasty surgery in August 2017 and was still convalescing from the surgery when he suffered a stroke in April 2018, which required hospitalization. Tagoe maintained that the injuries he suffered in the subject MVA have contributed to his present inability to work. In December 2019, Tagoe submitted a second OCF-3 to TPIC, which indicated that he was now substantially unable to perform the essential tasks of his employment, and that he was not able to return to work on modified hours or duties. In response, TPIC advised by way of a further EOB that “Please refer to our explanation of benefits dated May 19 2016[1] [sic], which states that you are not eligible for income replacement benefit. Furthermore, you are statue [sic] barred from disputing our stoppage as it is over 2 years.”

Denial of IRB

Tagoe challenged TPIC’s refusal to pay him IRBs by applying to the LAT by way of a February 3, 2021, application. It was the position of TPIC that the two-year limitation period under s. 56 of the SABS began to run when TPIC sent Tagoe the May 20, 2016 EOB advising him that he was not eligible for IRBs. Accordingly, Tagoe’s application to the LAT, which he made nearly five years later, was brought out of time. Tagoe argued that his entitlement to receive IRBs only became discoverable when he stopped working in the summer of 2017, and that the two-year limitation clock for him to apply to the LAT only began to run on June 17, 2020, the date of TPIC’s second EOB refusing his claim for IRBs.

Discoverability

The crux of Tagoe’s discoverability argument was that since he was still working in May 2016, when he submitted his initial OCF-1 and OCF-3 forms, he was not yet entitled to receive IRBs. He argued that “it was therefore premature for [TPIC] to deny IRBs when they had not been applied for.” The Tribunal disagreed, stating that “There is a considerable body of case law that deals with premature benefit claims and with claims that are denied pre-emptively by an insurer. I find that a benefit can be denied by an insurer pre-emptively and that the use of the phrase “you do not qualify” would be found to be acceptable under the Schedule.” The Tribunal then ruled that Tagoe was statute-barred from challenging TPIC’s refusal to pay him IRBs, and dismissed his application, as well as the subsequent request for reconsideration.

Divisional Court Allows Appeal & Leave Then Granted to Appeal Court Decision

Tagoe then appealed to the Divisional Court, which allowed the appeal on the grounds that the LAT adjudicator had erred by not properly considering whether Tagoe’s IRB claim was discoverable in May 2016, when he was still working. The earlier court disagreed that the denial of income replacement benefits in May 2016 created the dispute that had to be addressed in two years. Tagoe “did not qualify for income replacement in May 2016 and did not apply for it. I cannot distinguish this case from Tomec. The appellant was not required to apply for income replacement benefits before he was eligible for them. The adjudicator erred in law by failing to apply the doctrine of discoverability.” Given that the Tribunal had not addressed the substantive merits of Tagoe’s claim that he was entitled to receive IRBs under ss. 5 and 6 of the SABS more than two years after his accident, the Divisional Court remitted the matter to the LAT for a new hearing. Subsequently, on March 15, 2024, a different panel of the court granted TPIC leave to appeal from the Divisional Court’s decision.

Positioning on Appeal Amended

In its leave application materials and in its factum on appeal, TPIC took the position that Tomec was “not applicable. However, in his oral submissions TPIC’s counsel clarified that he is not arguing that the rule of discoverability does not apply to IRB claims. He also conceded in oral argument that it was an error for the LAT adjudicator to conclude that a pre-emptive denial of IRBs by TPIC in May 2016 would have started the limitations clock, even if Mr. Tagoe could not properly be seen as having applied for these benefits at that time. Rather, counsel focused on a different argument, contending that the Divisional Court erred by finding that Tagoe “did not qualify for income replacement in May 2016 and did not apply for it.”

Respective Positions

Advancing a number of arguments, it was TPIC ‘s position that “the adjudicator’s reasons show that she also implicitly found as a fact that Mr. Tagoe had applied for IRBs in May 2016…(and) since appeals from LAT decisions are limited to questions of law, the Divisional Court erred by making its own contrary factual finding that Mr. Tagoe “did not qualify for income replacement in May 2016 and did not apply for it.” Tagoe however contended that “he did not apply for IRBs in May 2016 because he was still working at the time, and accordingly did not meet the statutory requirement that his injuries had rendered him substantially unable to perform the essential tasks of his employment. He emphasizes that his OCF-1 form expressly stated that his injuries were not preventing him from working, and that the OCF-3 form submitted by the physiotherapist also stated that Mr. Tagoe was continuing to work.”

Get Your Stats Report!

inHEALTH’s Statistical Reports provide insights and analysis on the outcomes of Licence Appeal Tribunal (LAT) and court decisions.

Customize success rate reports on any variable relating to disputed AB claims captured in LAT and court decisions!

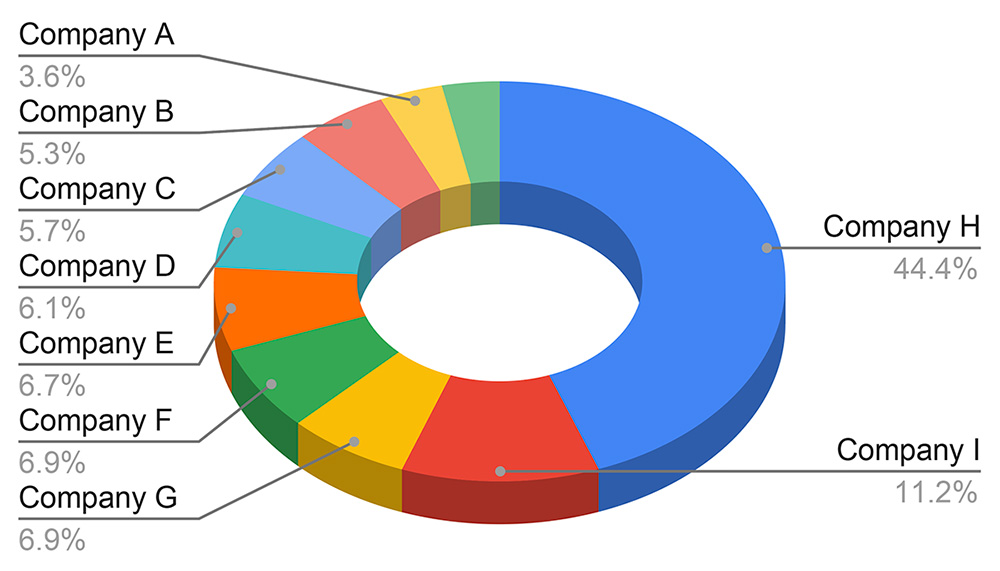

Decisions By Top 10 Insurers

*Sample Chart

Statistical Report fees are based on the complexity of your data request

Learn More & Get a Quote Here >

New Argument

Tagoe further took the position that “TPIC did not take the position before the LAT or the Divisional Court that Mr. Tagoe had been eligible for IRBs and had applied for them in May 2016, but instead litigated the case on the basis that TPIC’s denial of IRBs started the limitation clock, even if it was a pre-emptive denial. He argues that TPIC should not be able to advance a new argument for the first time on a second-level appeal.”

The Court’s Analysis

The court did “not agree with TPIC that the fact that Mr. Tagoe’s May 17, 2016 OCF-3 form checked off the box stating that he was statutorily eligible for IRBs inevitably leads to the conclusion that he was applying for these benefits at that time.” Reference was made to Tagoe’s “statement in his OCF-1 that his injuries were not preventing him from working implied that he did not meet the threshold eligibility criterion of suffering “a substantial inability” to perform the essential tasks of his employment. Indeed, this was the conclusion reached by TPIC’s adjuster who issued the May 20, 2016 EOB.”

The court made clear that it was “not suggesting that the evidence in this case automatically compelled the conclusion that Mr. Tagoe was not applying for IRB benefits in May 2016. The point is simply that there was conflicting evidence about his intentions at that time. We also do not agree with TPIC that the LAT adjudicator’s reasons can be read as implicitly rejecting Mr. Tagoe’s contention that he had not applied for IRBs in May 2016. Rather, her reasons show that she found it unnecessary to decide this point, because she believed that TPIC was entitled to pre-emptively deny him these benefits, whether he had applied for them or not. We accordingly do not accept TPIC’s argument that the Divisional Court improperly substituted its own finding of fact for a contrary factual finding that had been made by the LAT adjudicator. In the absence of any factual finding by the LAT adjudicator about whether the documents Mr. Tagoe submitted in May 2016 constituted an application for IRBs, the Divisional Court was entitled to “draw inferences of fact from the evidence”.

The court was “not persuaded that it would be appropriate in the circumstances here for us to set aside the Divisional Court’s finding that Mr. Tagoe had not applied for IRBs in May 2016, and vary the Divisional Court’s remittal order to leave this factual issue to be determined by the LAT. Prior to arguing its appeal in this court, TPIC chose to litigate the case on the basis that it was entitled to pre-emptively deny Mr. Tagoe IRBs, whether or not he had applied for them. We do not criticize TPIC’s new appellate counsel for resiling from this position, which we agree is no longer tenable in light of Tomec. However, it would not be fair to Mr. Tagoe to grant TPIC a remedy that it did not seek in the court below, based on a new argument that it makes for the first time on appeal.”

Conclusion and Disposition

We conclude that “the Divisional Court did not err in finding that the doctrine of discoverability applies in this context. The appellant argues that the Divisional Court concluded that the respondent’s application to the LAT was not limitations-barred by improperly reversing the LAT adjudicator’s implied finding of fact about when the respondent first applied for income replacement benefits, on an appeal that was limited to questions of law. We disagree that the LAT adjudicator made any implicit factual finding on this point. Accordingly, the appeal is dismissed.” As agreed, Tagoe would receive $15,000 all inclusive as his costs on the appeal.

Access inHEALTH’s research resources through Live Chat and receive your OAR. Get It now!