Volume. 7 Issue. 30 – August 16, 2023

This week we take an extended look at a case wherein the Tribunal considered whether they had jurisdiction to grant the equitable remedy of relief from forfeiture. You will want to read this detailed account, as the Tribunal finds for a fact that the Tribunal does have the requisite jurisdiction, and further finds that the Applicants were entitled to the equitable remedy of relief from forfeiture.

LAT Update – What Difference Did A Year Make?

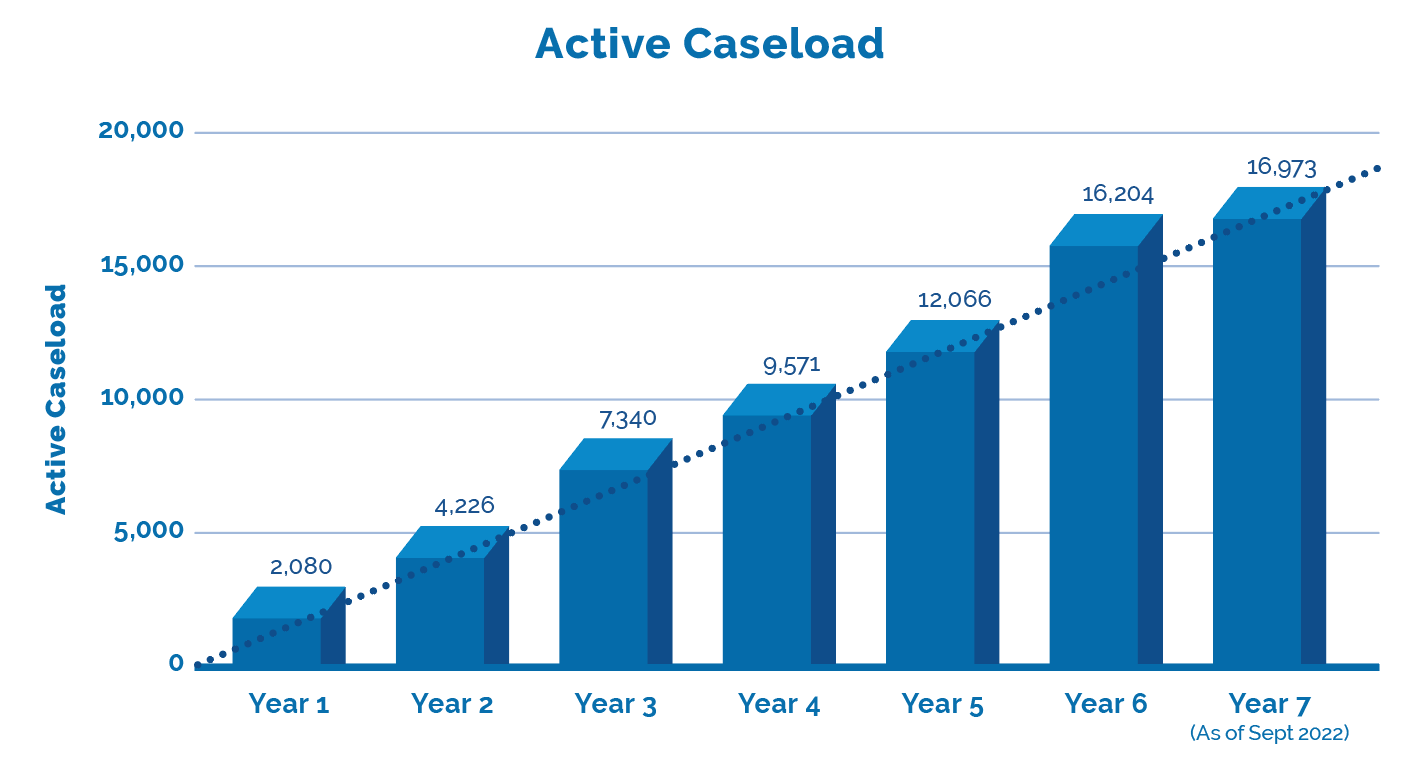

The LAT released Performance Stats up to mid-year 7 which is current through to the end of September 2022. Together with the LAT’s last update we can now provide a comparison of year over year, with projections through to the end of year 7 in this annual update. What difference did a year make?

Tribunal Grants Relief From Forfeiture

Relief From Forfeiture Granted by Tribunal – The applicant Yaromich was seriously injured in a June 26, 2020 accident. At the time, Yaromich had two automobile insurance policies, a standard policy with Economical and a 2nd policy with Heartland, that included enhanced benefits. At issue, in 21-007349 v Heartland Farm Mutual, was whether Yaromich could seek benefits from Heartland, given that the initial application was filed with Economical. On July 9, 2020, the broker for Yaromich advised Heartland that they intended to seek the enhanced benefits available under their policy. Concurrently, Yaromich’s daughter was apparently counseled by a representative of Economical to seek benefits through them, and to then later seek the enhanced benefits through Heartland.

Priority Between Standard and Enhanced Policy

On July 17, 2020, Economical sent Heartland a Priority Dispute, indicating that priority was with Heartland due to the enhanced benefits. In response, Heartland denied any liability for the claim, given that the 1st application was filed with Economical. On August 7, 2020, counsel for Yaromich wrote Heartland, demanding that they accept the claim, in that Yaromich had inadvertently applied to Economical, the unfairness in denying access to enhanced benefits, referencing as well the prospect of a relief from forfeiture. Given the continued refusal, Yaromich sought a declaration from the Court that they are entitled to relief from forfeiture and are entitled to enhanced benefits from Heartland. However, the Court denied the request, as the Tribunal holds jurisdiction over such disputes and the issue should be heard by the Tribunal.

Jurisprudence Considered

The Tribunal hearing the matter, noted that “While the issue is framed as whether the Applicants are entitled to relief from forfeiture, they ultimately seek entitlement to the enhanced accident benefits they purchased.” Yaromich contended that relief from forfeiture is available because the LAT Act does not prohibit the application of equitable remedies, and that “permitting the Tribunal with the ability to provide equitable relief is consistent with the consumer protection objective.” For their part, Heartland countered that “the Tribunal has contemplated whether it can grant equitable relief and that it concluded that it does not have the jurisdiction or authority to grant equitable remedies.”

The Tribunal considered case law referenced by Heartland, ultimately finding that the cases relied upon on the issue of equitable remedy were all unpersuasive and distinguishable. In Fehr v. Intact Ins. Co, the Tribunal “found no enabling statutes that expressly permits equitable remedies like waiver or estoppel to be applied and concluded that the Tribunal has no broad discretionary power to do so. However, herein the Tribunal found these comments “unpersuasive because that case addressed an issue that is contemplated by the Schedule and has a remedy for it.” Therefore, Fehr was “distinguishable because it never required an equitable remedy. The remedy for Fehr – finding that the incident was indeed an accident – is provided by the Schedule. In the Applicants’ case here, there is no remedy provided by the Schedule to correct the error made by applying to Economical instead of Heartland.”

Similarly, 16-001810 v. Aviva Insurance was found unpersuasive, as the remedy sought therein would not be available in the situation described, given that same would be contrary to the applicable section of the Schedule. The Tribunal did however note that section 98 of the Courts of Justice Act (that allows for relief from forfeiture) “is not expressly available to the Tribunal. The Legislature clearly restricted section 98 to courts only… illustrates clear legislative recognition of the difference between courts and tribunals and, applying the rule of consistent interpretation, the omission of boards and tribunals from section 98 indicates its availability to a court only.”

The reconsideration decision, J.T. and Aviva Canada Inc, “concluded that the legislature would have included equitable relief such as estoppel as a remedy had the intention been to include it.” The Tribunal however found the reasons for not granting the remedy unpersuasive. J.T. was distinguishable, as it “considered an equitable issue that is contemplated in the Schedule, which includes a remedy for the issue. Whereas in the Applicants’ case, there is no section in the Schedule or Insurance Act which expressly guides parties on how to address a situation where an insured applies to one policy when they intend to apply to another policy with greater coverage for benefits.”

Heartland relied “heavily” on the private arbitration decision, Jevco Insurance Company v. Chieftain Insurance Company, a priority dispute wherein the insured had a standard policy and an enhanced benefits policy. This was found to be “remarkably similar”, however was not binding and was distinguishable. In that case, “the discrete issue of whether the insured was entitled to enhanced benefits was never addressed in Jevco but instead, explicitly omitted from the decision. Indeed, the arbitrator speculated on the application of her interpretation following the decision, but she correctly noted that addressing entitlement was not an issue before her.”

Suggestion of the Court

The Tribunal next considered the aforementioned decision of the Court, wherein Justice Turnbull suggested that Yaromich “could rescind their initial application for benefits and apply pursuant to the policy with access to enhanced benefits. The Justice suggested that this solution was compliant with the Schedule and noted that nothing in the Schedule prevented the Applicant from this action, so long as he maintained only one application for benefits.” The Tribunal found this to be “a compelling resolution. Granting the Applicant’s relief from forfeiture and permitting them to rescind their application for benefits and apply to Heartland is compliant with the Schedule because there is nothing in the Schedule that prohibits it, especially in rare circumstances such as the Applicants’.”

Procedural Fairness

The Tribunal also found persuasive comments in Continental Casualty Company v Chubb Insurance Company of Canada, to wit “I observe that potential unfairness arising from an insured’s errors when applying for SABS may, in some cases, be corrected by invoking relief from forfeiture as happened in this case.” This statement was seen as “clear and compelling in light of the similar fact scenarios in Jevco and the present case.” The Tribunal then agreed with Yaromich “that section 129 of the Insurance Act provides jurisdiction to provide relief from forfeiture in the rare situation such as the Applicants’, where there is imperfect compliance with a statutory condition related to proof of loss.”

Jurisdiction

Further, “excluding jurisdiction to this Tribunal to provide relief from forfeiture as described in section 129 of the Insurance Act creates an unfair situation for the Applicants that must be avoided in order to remain consistent with the consumer protection nature of the Insurance Act and the Schedule. Denying the Tribunal jurisdiction to award relief from forfeiture in this scenario forces the Applicants to frivolously exhaust their appeal options with the Tribunal in order to advance to the Court and attempt to seek a potential remedy provided to them through section 129 of the Insurance Act.” The “best way to resolve this issue is to permit the Tribunal with the jurisdiction outlined in section 129 of the Insurance Act and allow it, in this rare and extraordinary circumstance, to provide relief from forfeiture.”

Test for a Relief from Forfeiture

The Tribunal next applied the test for a relief from forfeiture, being the gravity of the breaches, and the disparity of the property forfeited and the damage caused by the breach. All three tests were found to be in favour of Yaromich, as the “innocent mistake” would result in a loss of significant benefits, with a resulting “windfall” for Heartland, who were simply being asked to provide benefits that Yaromich had in fact been paying for.

Remedy

It was also found “contrary to the consumer protection nature of the Schedule and the equitable principles established through the common law to impose such a barrier when no barrier is provided.’ Additionally, “a finding that the Applicant’s application for benefits is irrevocable, without legislation stating so, would be inconsistent with other provisions outlined in of the Schedule.” Holding Yaromich to be irrevocably obliged to seek only standard benefits through Economical, would be “patently unfair and detrimental to the insured person… particularly the case when the Schedule is silent on the issue and does not, in fact, prohibit an insured person from rescinding their application.

Concluding, the Yaromich’s “erred in their initial application for benefits, but the Schedule provides no remedy for the situation. It would be unfair to deprive the Applicants of access to benefits at the level they paid for and are entitled to. As a result, and for the reasons outlined above, I find that the Applicants are entitled to relief from forfeiture with respect to their initial application for accident benefits.” Therefore, the initial application with Economical was rescinded, and the Yaromich’s were permitted to initiate a claim through Heartland, pursuant to their policy which includes access to enhanced benefits.”

Access inHEALTH’s research resources through Live Chat and receive your OAR. Get It now!